Previous slide

Next slide

Zadnje novice ZDSS

Revija DFP – September 2023

Po poletnem oddihu je z vami septembrska številka DFP. Najbrž ste že zakopani v delo, vendar to naj vas ne odvrne od kvalitetnega branja. V tej številki vam Simona Štravs, davčna svetovalka ZDSS, predstavlja ukrepe (kakor tudi pomembne roke) za pomoč gospodarstvu zaradi poplav. Mag. Franc Derganc, predsednik ZDSS, razpravlja o

September 28, 2023

Predstavitev Zbornice davčnih svetovalcev Slovenije

Video pove več kot 1000 besed

3 Videos

Zakaj postati član ZDSS?

- Neprecenljivo povezovanje, izmenjava mnenj in izkušenj v strokovnem krogu članov ZDSS.

- Brezplačna mesečna izobraževanja, kjer razpravljamo o aktualnih temah in izmenjujemo dobre prakse (vsaj 8x letno).

- Ekskluzivna kotizacija na osrednjih letnih dogodkih ZDSS (Kongres in Dan ZDSS).

- Ugodnejše zavarovanje za izvajanje dejavnosti davčnega svetovanje preko skupne police.

- do -50% popust na strokovno revijo Davčno-finančna praksa in e-arhiva od leta 2000 dalje.

- Informiranje o davkih v Sloveniji in EU.

- Dodatne ugodnosti preko naših partnerjev in stanovskih organizacij.

- In druge ugodnosti članstva v ZDSS.

Pridružite se našemu strokovnemu krogu in soustvarjajte davčno stvarnost.

Dan ZDSS 2024

Udeleženci Dneva ZDSS v Urban Ringu hotelu v Ljubljani

Predstavniki ZDSS na 25. Davčno finančni konferenci v Portorožu

Razgledni stolp Rimske Terme

Udeleženci 27. kongresa ZDSS 2024

27. kongres ZDSS 2024

Govorci in organizatorji 27. kongresa ZDSS

Prejemniki certifikata "Davčni svetovalec ZDSS" 2024

Okrogla miza s sodelujočimi gosti na 27. kongresu ZDSS 2024

mag. Katja Božič, državna sekretarka, pristojna za davke, carine in druge dajatve ter izboljšanje učinkovitosti javne porabe, na Dnevu ZDSS 2023

ddr. Marian Wakounig, častni član ZDSS, Avstrijska finančna uprava na Dnevu ZDSS 2023

30. obletnica davčnega svetovanja v Sloveniji

Razstava ob 30. letnici davčnega svetovanja v RS

26. kongres ZDSS, Terme Čatež

ddr. Marian Wakounig, častni član ZDSS, Avstrijska finančna uprava, na 26. kongresu ZDSS

Suzana Tokić, ST Konzultacije d.o.o. na 26. kongresu ZDSS 2023

Maja Dolinar Dubokovič, davčna svetovalka, Movens d.o.o. na 26. kongresu ZDSS

Silva Koritnik Rakela, Izobraževalna hiša Cilj d.o.o. na 26. kongresu ZDSS

Mihael Pojbič, mag. prav., pravni in davčni svetovalec, na 26. kongresu ZDSS

Dean Košar, LL.M., davčni svetovalec ZDSS, Lek d.d. na 26. kongresu ZDSS

Mirjam Trdan, Simona Štravs in ddr. Marian Wakounig na 26. kongresu ZDSS 2023

Okrogla miza z dolgoletnimi člani: Boštjan Petauer, Zvezda Balič-Fabe, Lučka Kariž, Simona Štravs, Majda Lukner in drr. Marian Wakounig, 26. kongres ZDSS

Simona Štravs, vodja okrogle mize na slavnostni večerji ob 30. obletnici davčnega svetovanja v RS

30. let davčnega svetovanja v RS - Terme Čatež, 2023

Udeleženci Dneva ZDSS 2022

Peter Grum, v.d. generalnega direktorja FURS, Dan ZDSS 2022

Dušan Jeraj, iConsult na 25. kongresu ZDSS

Mirjam Trdan vodja organizacijskega odbora 25. kongresa ZDSS in Dušan Jeraj, iConsult

Dean Košar, LL.M., 25. kongres ZDSS 2022

Okrogla miza na 25. kongresu ZDSS 2022

Tamara Kek in ddr. Marian Wakounig na 25. kongresu ZDSS

Darja Gregorčič Bernik, odgovorna urednica revije DFP in članica UO ZDSS na 25. kongresu ZDSS

Izlet udeležencev 25. kongresa ZDSS 2022

Arhiv dogodkov ZDSS

Arhiv dogodkov ZDSS

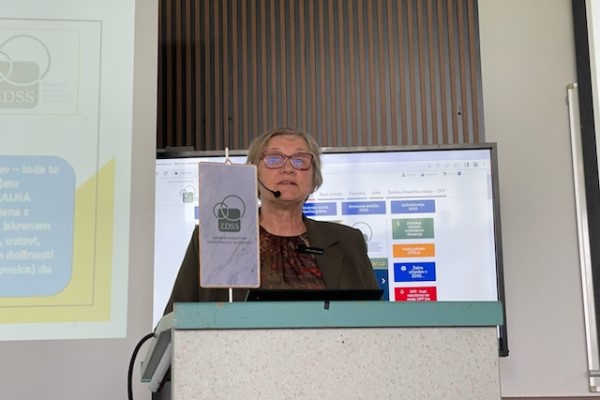

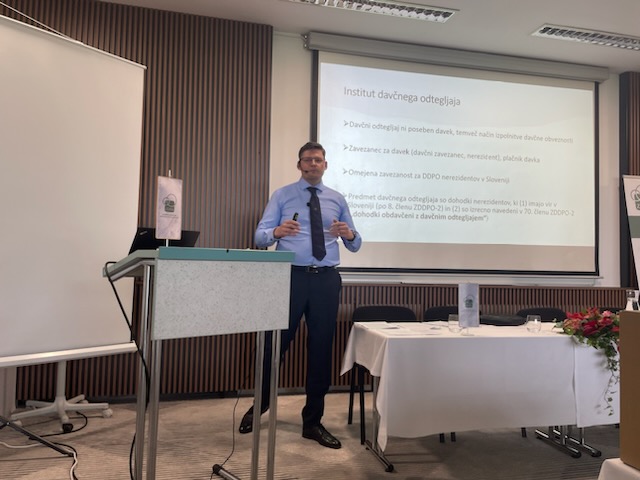

Predavatelji...