Previous slide

Next slide

Zadnje novice ZDSS

CELEX:62022CA0108: Case C-108/22, Dyrektor Krajowej Informacji Skarbowej (VAT — Hotel services consolidator): Judgment of the Court (Eighth Chamber) of 29 June 2023 (request for a preliminary ruling from the Naczelny Sąd Administracyjny — Poland) — Dyrektor Krajowej Informacji Skarbowej v C. sp. z o.o., in liquidation (Reference for a preliminary ruling — Common system of value added tax (VAT) — Directive 2006/112/EC — Special scheme for travel agents — Scope — Consolidator of accommodation services which purchases such services on its own behalf and resells them to other professionals without ancillary services)

August 14, 2023

CELEX:62021CA0829: Joined Cases C-829/21 and C-129/22, Stadt Frankfurt am Main (Renewal of a residence permit in the second Member State) and Others: Judgment of the Court (Second Chamber) of 29 June 2023 (requests for a preliminary ruling from the Hessischer Verwaltungsgerichtshof (C-829/21) and the Verwaltungsgericht Darmstadt (C-129/22) — Germany) — TE, RU, represented for legal purposes by TE (C-829/21), EF (C-129/22) v Stadt Frankfurt am Main (C-829/21), Stadt Offenbach am Main (C-129/22) (Reference for a preliminary ruling — Immigration policy — Status of third-country nationals who are long-term residents — Directive 2003/109/EC — Second subparagraph of Article 9(4), Article 14(1), second subparagraph of Article 15(4), Article 19(2) and Article 22 — Right of third-country nationals to long-term resident status in a Member State — Grant by the first Member State of a ‘long-term resident’s EU residence permit’ of unlimited duration — Third-country national absent from the territory of the first Member State for a period of more than six years — Consequent loss of entitlement to long-term resident status — Application for renewal of a residence permit issued by the second Member State pursuant to the provisions of Chapter III of Directive 2003/109/EC — Application rejected by the second Member State because of the loss of that entitlement — Conditions)

August 14, 2023

Zakaj postati član ZDSS?

- Neprecenljivo povezovanje, izmenjava mnenj in izkušenj v strokovnem krogu članov ZDSS.

- Brezplačna mesečna izobraževanja, kjer skrbimo za dodano vrednost naših članov (vsaj 8x letno).

- Ekskluzivna kotizacija na osrednjih letnih dogodkih ZDSS (Kongres in Dan ZDSS).

- do -50% popust na strokovno revijo Davčno-finančna praksa in e-arhiva od leta 2000 dalje.

- Informiranje o davkih v Sloveniji in EU.

- Dodatne ugodnosti preko naših partnerjev in stanovskih organizacij.

- In druge ugodnosti članstva v ZDSS.

Dovolimo si, da nas davki povezujejo!

Dan ZDSS 2024

Udeleženci Dneva ZDSS v Urban Ringu hotelu v Ljubljani

Predstavniki ZDSS na 25. Davčno finančni konferenci v Portorožu

Razgledni stolp Rimske Terme

Udeleženci 27. kongresa ZDSS 2024

27. kongres ZDSS 2024

Govorci in organizatorji 27. kongresa ZDSS

Prejemniki certifikata "Davčni svetovalec ZDSS" 2024

Okrogla miza s sodelujočimi gosti na 27. kongresu ZDSS 2024

mag. Katja Božič, državna sekretarka, pristojna za davke, carine in druge dajatve ter izboljšanje učinkovitosti javne porabe, na Dnevu ZDSS 2023

ddr. Marian Wakounig, častni član ZDSS, Avstrijska finančna uprava na Dnevu ZDSS 2023

30. obletnica davčnega svetovanja v Sloveniji

Razstava ob 30. letnici davčnega svetovanja v RS

26. kongres ZDSS, Terme Čatež

ddr. Marian Wakounig, častni član ZDSS, Avstrijska finančna uprava, na 26. kongresu ZDSS

Suzana Tokić, ST Konzultacije d.o.o. na 26. kongresu ZDSS 2023

Maja Dolinar Dubokovič, davčna svetovalka, Movens d.o.o. na 26. kongresu ZDSS

Silva Koritnik Rakela, Izobraževalna hiša Cilj d.o.o. na 26. kongresu ZDSS

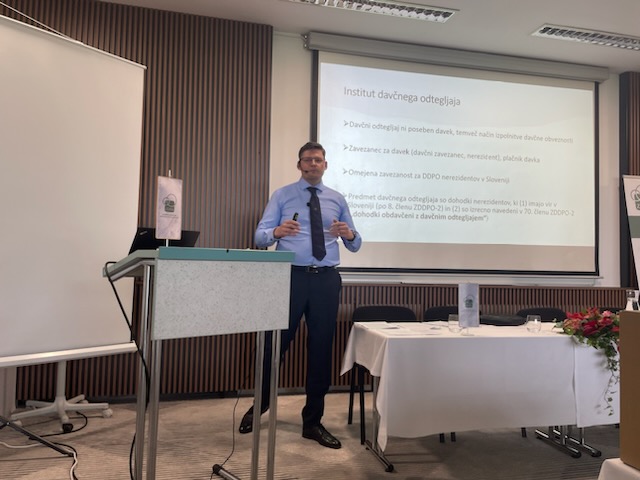

Mihael Pojbič, mag. prav., pravni in davčni svetovalec, na 26. kongresu ZDSS

Dean Košar, LL.M., davčni svetovalec ZDSS, Lek d.d. na 26. kongresu ZDSS

Mirjam Trdan, Simona Štravs in ddr. Marian Wakounig na 26. kongresu ZDSS 2023

Okrogla miza z dolgoletnimi člani: Boštjan Petauer, Zvezda Balič-Fabe, Lučka Kariž, Simona Štravs, Majda Lukner in drr. Marian Wakounig, 26. kongres ZDSS

Simona Štravs, vodja okrogle mize na slavnostni večerji ob 30. obletnici davčnega svetovanja v RS

30. let davčnega svetovanja v RS - Terme Čatež, 2023

Udeleženci Dneva ZDSS 2022

Peter Grum, v.d. generalnega direktorja FURS, Dan ZDSS 2022

Dušan Jeraj, iConsult na 25. kongresu ZDSS

Mirjam Trdan vodja organizacijskega odbora 25. kongresa ZDSS in Dušan Jeraj, iConsult

Dean Košar, LL.M., 25. kongres ZDSS 2022

Okrogla miza na 25. kongresu ZDSS 2022

Tamara Kek in ddr. Marian Wakounig na 25. kongresu ZDSS

Darja Gregorčič Bernik, odgovorna urednica revije DFP in članica UO ZDSS na 25. kongresu ZDSS

Izlet udeležencev 25. kongresa ZDSS 2022

Arhiv dogodkov ZDSS

Arhiv dogodkov ZDSS

Predavatelji...